The ongoing US-China trade war has caused significant turbulence in global trade, impacting economies, industries, and supply chains.

What started as a tariff dispute in 2018 has expanded into a broader contest for economic and technological influence, with trade policy increasingly used as a strategic tool. As tariffs rise, uncertainty over their implementation adds pressure to global growth expectations, reshaping supply chains and forcing companies to rethink sourcing strategies and production continuity.

Global Supply Chain Disruptions

China’s exports to emerging Asia have risen sharply, driven by overcapacity in its manufacturing sector and sluggish domestic demand.

Countries such as Vietnam, Thailand, and Indonesia have absorbed large volumes of Chinese goods, many of which are subsequently re-exported to markets, including the US. This pattern has drawn heightened scrutiny, with the US signalling its intention to impose tariffs on goods transshipped through other countries to circumvent existing duties.

Emerging Asian markets are beginning to push back against these imports, prompting the introduction of anti-dumping duties and tighter customs procedures to protect local industries. This contest over tariffs is reshaping not only the flow of goods but also the broader dynamics of global trade in unpredictable ways.

The US-China trade war affects more than just pricing. Tariff shifts and expanding export controls are now reshaping supply reliability, forcing businesses to reassess sourcing concentration, geopolitical exposure, and contingency planning.

The consequences of trade tensions are particularly evident in the defence sector, where access to critical materials such as rare earths, semiconductors, and advanced electronics directly impacts manufacturing capacity and national security priorities.

Defence Sector on Alert

The defence industry is facing a period of heightened strategic risk as the US-China trade tensions intersect with broader geopolitical instability. What had been a relatively stable procurement environment has shifted toward an era where national security, economics, and supply chain vulnerabilities are deeply intertwined.

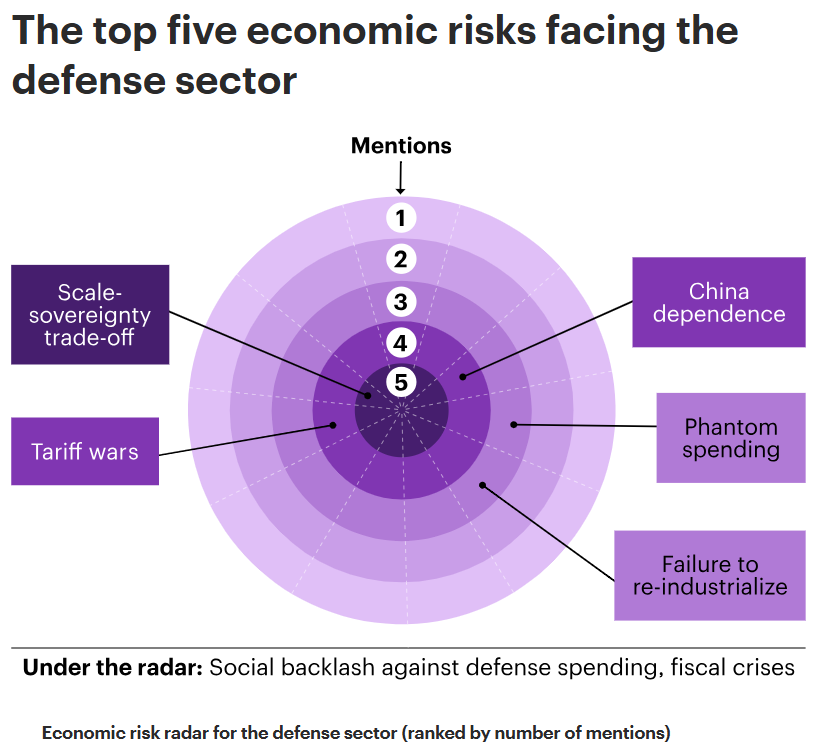

Recent analyses show that dependence on Chinese materials such as rare earth elements, semiconductors, and advanced electronics has emerged as one of the top risks for the global defence sector.

According to a report from the UK consultancy WTW, ongoing tariff wars and China’s dominance in critical materials supply expose defence manufacturers to major cost increases and supply uncertainty, even as demand for military systems rises worldwide. Key risks, such as tariff wars, phantom spending, and China’s growing influence in the sector, have heightened concerns, especially as geopolitical tensions escalate.

Source: WTW

Rare earth

Critical components, such as rare earths, are fundamental to modern defence technology. These materials are used in everything from precision guidance systems and radar arrays to motors and sensors in platforms such as fighter jets and missiles.

China currently controls around 85–90% of key rare earth processing and related magnet production, creating an acute chokepoint for defence supply chains and national security systems.

Export controls and restrictions on rare earths and related technologies have already been expanded amid trade tensions, heightening strategic risk. For instance, new Chinese export licensing requirements for rare earths, magnets, and minerals used in semiconductors and defence systems could tighten access for foreign manufacturers, potentially delaying production schedules and increasing costs across critical industries.

In response, the U.S. has increased investments to rebuild domestic capacity and reduce reliance on foreign sources. The Department of Defence has committed billions to expand rare earth within the United States, underscoring the strategic importance of these materials in safeguarding long-term national security and ensuring resilience against disruptions in the global supply chain.

Semiconductor and advanced electronics

The semiconductor sector has become a key vulnerability for the defence industry. It plays a vital role in technologies such as communications, radar systems, and missile guidance. Historically, the U.S. has restricted China’s access to advanced chips and manufacturing tools to limit Beijing’s technological advancements.

However, U.S. export policy has shifted recently to allow conditional sales of advanced AI chips like Nvidia’s H200, under strict oversight and national security safeguards. China has approved the import of these chips for selected customers, balancing access to foreign technology with efforts to strengthen its domestic semiconductor industry.

While this shift shows some flexibility, it also highlights persistent risks to the defence supply chain. Disruptions in semiconductor access, whether driven by policy changes or geopolitical tensions, continue to challenge defence production capabilities, particularly in securing reliable access to advanced microelectronics.

As global supply chains evolve, the reliability of material supplies, geopolitical leverage, and industrial resilience have become central to long-term readiness. National security planners must adopt innovative sourcing strategies and long-term policies to mitigate vulnerabilities stemming from the U.S.-China trade conflict. The future of military preparedness will hinge on the ability to navigate these shifting dynamics and address risks tied to economic nationalism and global uncertainties.

Trade Performance

Despite ongoing challenges from the US-China trade war, China’s economy hit its 5% GDP growth target for 2025, despite the negative impacts of US tariffs. A significant contributor to this growth was China’s export sector, which posted a record trade surplus of US$1.19 trillion in 2025.

Exports to markets such as Southeast Asia, Europe, and Africa surged, helping offset the decline in exports to the US.

In addition to China’s internal dynamics, the US-China trade war has also influenced other economies. While some countries have benefited from trade diversion, others face slower global demand and weaker investment.

Countries in East and Southeast Asia have notably increased exports, partially offsetting declines in US-China trade. However, global growth projections have been downgraded, with institutions such as the IMF and World Bank warning that tariff shocks could dampen growth in emerging markets.

China’s ability to maintain its trade surplus and meet its growth target has reinforced confidence in its economic strategies. Looking ahead, analysts predict China’s growth for 2026 will range between 4.5% and 5%, with a focus on transitioning to self-sustained growth.

The Road to a Potential Deal

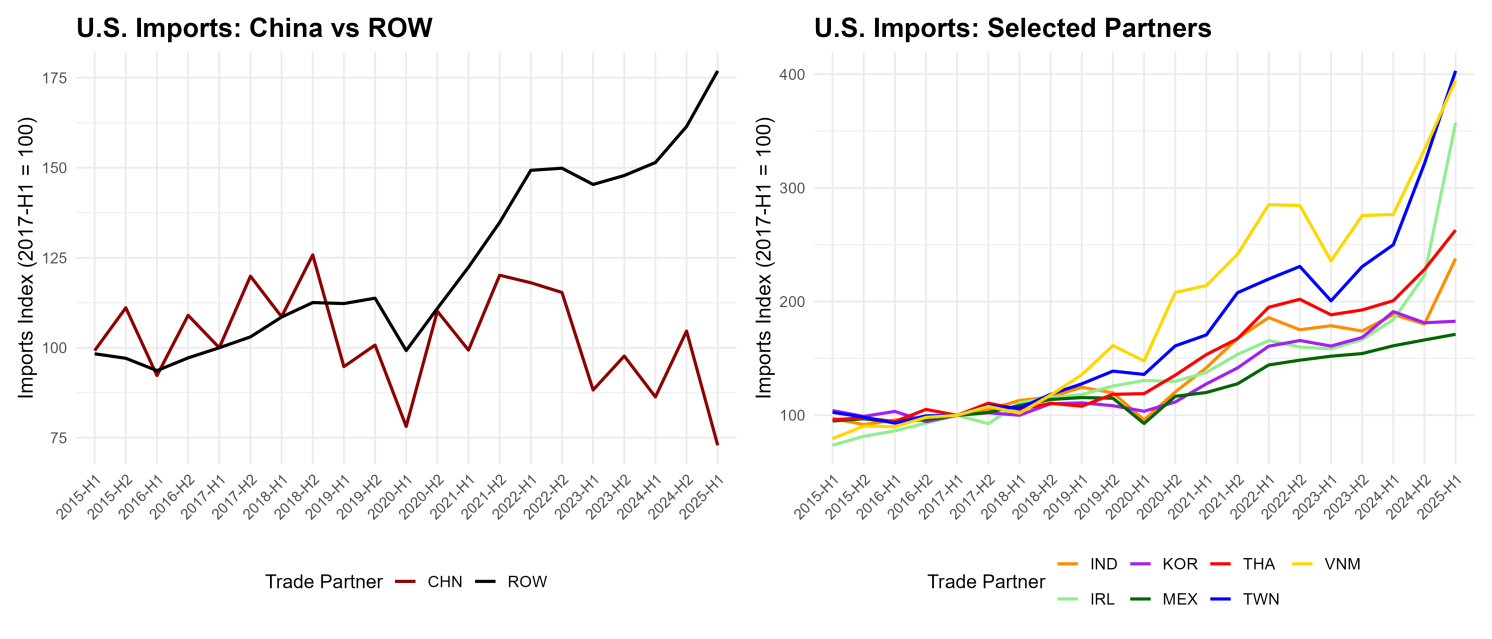

Since 2018, US imports from China have steadily declined, with countries such as Vietnam, Mexico, and Taiwan gaining market share as companies seek alternatives in response to higher tariffs on Chinese goods.

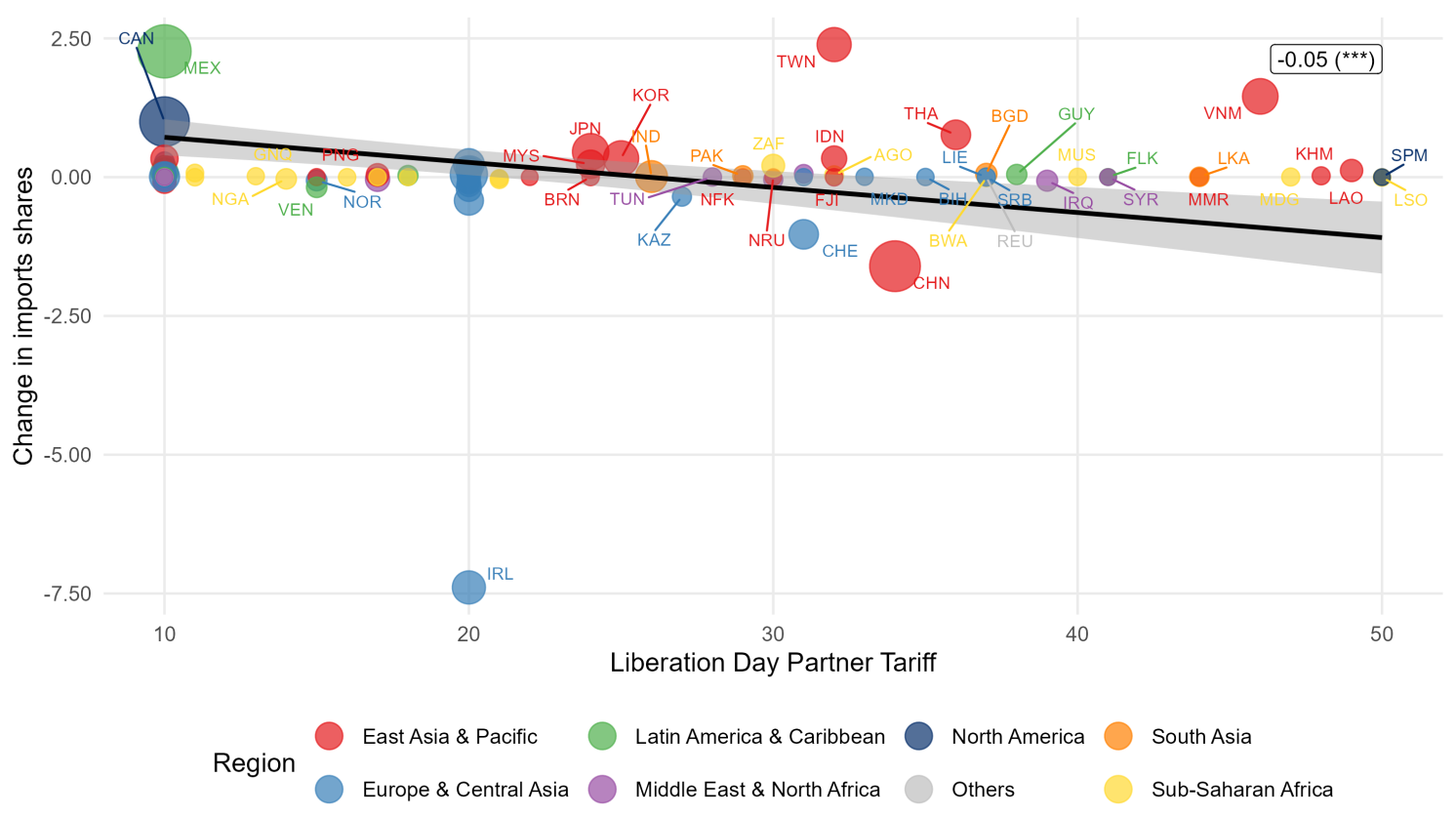

Changes in US imports by major trade partners from March to August 2025.

(Source: US Census Bureau data)

This shift has been accelerated by the Liberation Day tariffs introduced in 2025, which have significantly disrupted traditional supply chains. However, the diversification of trade partners remains largely limited to the top 20 US trade partners, reflecting a concentration of reallocated imports within established markets.

While this suggests a potential reconfiguration of global supply chains, China’s share of US imports has dropped significantly, signalling a deeper decoupling between the two economies.

As illustrated by recent trends, imports from China have decreased in favour of countries like Vietnam and Mexico, which have seen notable growth in market share as companies look to reduce their dependence on Chinese imports.

Changes in US imports by major trade partners 2015 – 2025.

(Source: US Census Bureau data)

Despite this reallocation, the overall growth in US imports has not been as diversified as expected. While Mexico and Vietnam have gained significant ground, much of the reallocation has occurred among the top 20 trading partners, leaving limited space for smaller economies to make substantial inroads. This trend indicates that while sourcing strategies are shifting, the global trade network remains largely centred on a small group of established trade partners.

The future of US-China trade then hinges on whether tariffs will remain a permanent fixture in the global trade landscape or if both nations can find a way to de-escalate tensions. Protectionism has become increasingly prominent in shaping trade policy, and the path to a trade deal that addresses issues such as trade imbalances and market access will be crucial in determining the trajectory of global trade over the next few years.

A Time for Transformation

The US-China trade war has disrupted global trade, especially in critical industries like defence, where access to materials such as rare earths, semiconductors, and electronics has become a strategic risk. As tariffs rise and geopolitical tensions intensify, companies are reassessing their sourcing strategies and supply chain resilience.

Despite these challenges, China has maintained strong economic growth and a robust export sector. The future of US-China trade will depend on whether both nations can resolve tensions, as their negotiations will play a key role in shaping global trade dynamics and economic growth in the years to come.

Want more insights on market trends and the US-China trade war? Create a live account with VT Markets today and stay informed with real-time market updates and expert commentary.