Monthly Archives: March 2025

Trading above 1.3000, the GBP/USD pair maintains a positive trend for four consecutive sessions

Written on March 20, 2025 at 5:53 am, by anakin

UBS believes Nvidia’s decline offers a promising buying opportunity and maintains a Buy rating.

Written on March 20, 2025 at 5:51 am, by anakin

Brazil’s central bank increased its benchmark interest rate to 14.25%, indicating future adjustments may follow

Written on March 20, 2025 at 5:21 am, by anakin

Following the Fed’s rate decision, the silver price (XAG/USD) trades near $33.80 per ounce

Written on March 20, 2025 at 4:53 am, by anakin

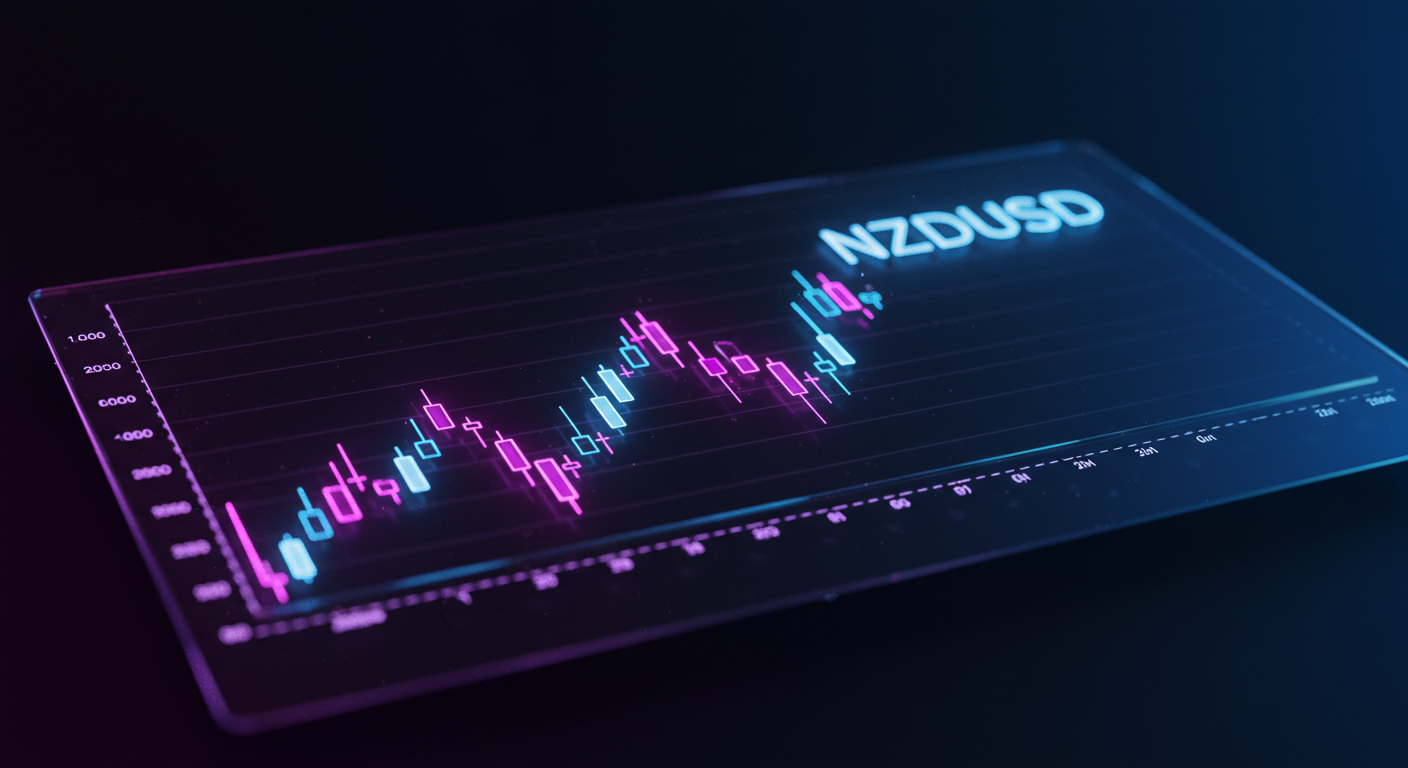

The economy of New Zealand grew by 0.7%, surpassing the Reserve Bank’s prediction of 0.3%

Written on March 20, 2025 at 4:51 am, by anakin

For a second consecutive day, the Japanese Yen strengthens against the US dollar, reaching a weekly high

Written on March 20, 2025 at 4:24 am, by anakin

The Financial Times presents a pessimistic perspective on the FOMC outcome, despite equities responding positively

Written on March 20, 2025 at 4:21 am, by anakin

President Trump urged the Federal Reserve to decrease interest rates due to economic harm from tariffs

Written on March 20, 2025 at 3:53 am, by anakin