Monthly Archives: May 2025

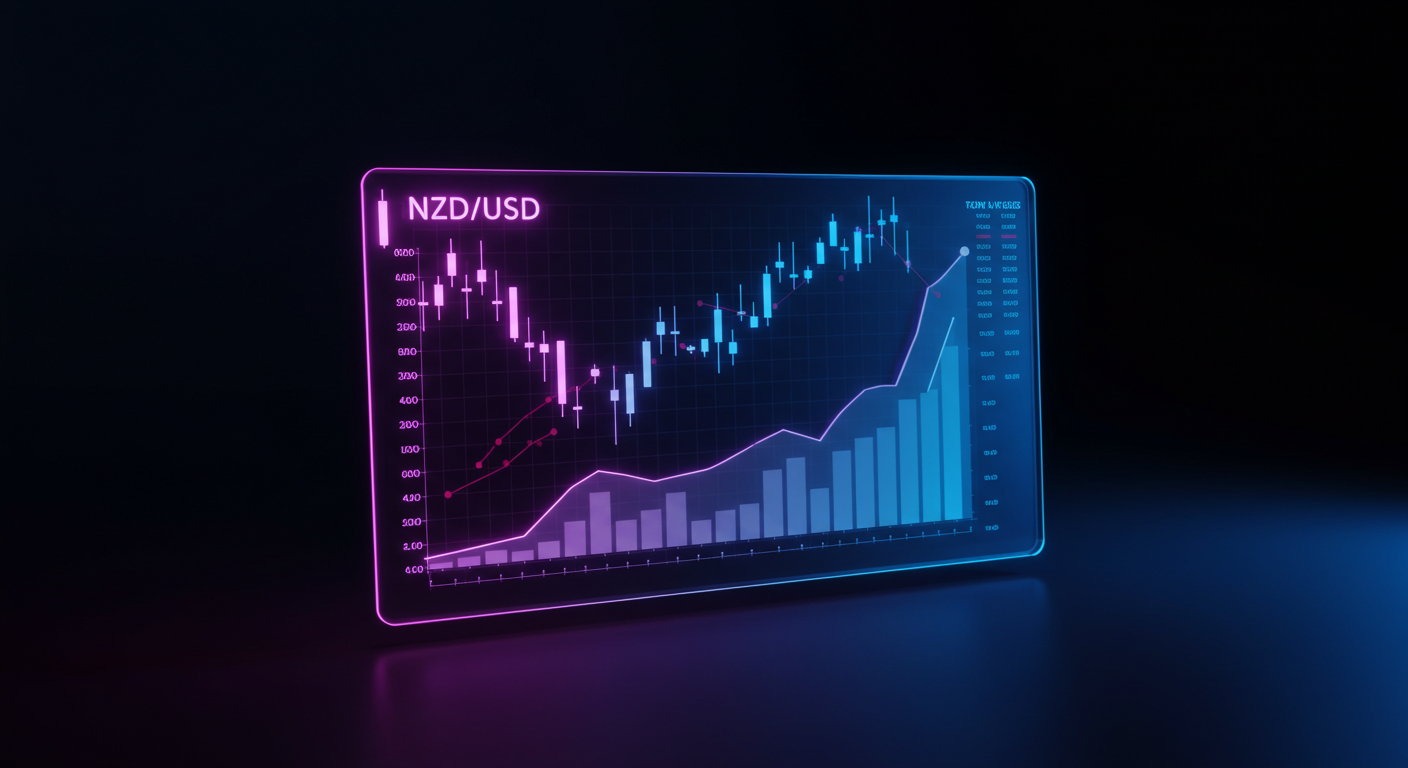

The NZD/USD pair trades near 0.5950, experiencing consolidation while halting its recent gains

Written on May 20, 2025 at 10:10 am, by anakin

NZD/USD consolidates near 0.5930; bullish momentum targets 0.6000 with key support at 0.5913 EMA.

Around $62.00, WTI Oil trades lower as markets assess Russia-Ukraine peace talks’ impact on supply

Written on May 20, 2025 at 9:40 am, by anakin

WTI oil drops to $62 amid Russia-Ukraine ceasefire talks, weak China data, and OPEC supply concerns.

US stocks rose, with Emini S&P surpassing 5890, achieving the predicted targets of 5925/30 and 5950/60

Written on May 20, 2025 at 9:10 am, by anakin

Emini indices face resistance; support levels hold. Nasdaq profits exceed 400 ticks. EUR/USD steady; gold resilient.

Consolidating near 100.35, the US Dollar Index hovers close to a week’s low

Written on May 20, 2025 at 8:40 am, by anakin

US Dollar remains subdued amid Fed rate cut expectations, weak data, and mixed global economic signals.

Dividend Adjustment Notice – May 20 ,2025

Written on May 20, 2025 at 8:14 am, by anakin

Dear Client, Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume”. Please refer to the table below for more details:Continue Reading

Following the May policy announcement, Governor Bullock of the RBA indicated potential future adjustments

Written on May 20, 2025 at 8:10 am, by anakin

RBA cuts rate to 3.85%; AUD falls amid economic concerns, iron ore prices, and Chinese trade links.

Near 93.00, selling pressure mounts on AUD/JPY as the RBA’s interest rate decision unfolds

Written on May 20, 2025 at 7:40 am, by anakin

AUD/JPY falls after RBA rate cut; BoJ hike speculation supports Yen amid global economic uncertainty.

The RBA’s interest rate decision aligned with expectations at 3.85% in Australia

Written on May 20, 2025 at 7:10 am, by anakin

RBA holds rates at 3.85%; EUR/USD rises; Gold steady; Solana recovers; China data shows resilience.

After the PBoC cut rates, NZD/USD hovers around 0.5900, experiencing downward pressure in trading

Written on May 20, 2025 at 6:40 am, by anakin

NZD/USD drops as China cuts rates; New Zealand faces inflation pressures; markets await RBA decision.

Japan’s Finance Minister Shunichi Kato anticipates discussions regarding foreign exchange with US Treasury Secretary Scott Bessent

Written on May 20, 2025 at 6:10 am, by anakin

Japan and US finance leaders to discuss FX stability; Yen closely watched amid shifting monetary policies.